Leading product teams building with GenAI, machine learning and AI PAAS

2010-2025

I build products that improve people’s lives through the thoughtful use of data and natural language. AI foundation models present new possibilities and new risks. But AI products have to solve a user problem, and drive a business, safely.

AI is the how, never the why.

Contribution

From position player to company founder, including programme lead, product manager, product designer, data engineer and full stack developer.

Currently strategy and market insight for Tanzu AI PAAS offering.

Delivery

I’ve shipped more than a dozen products on ML models and LLMs. These have gone on to IPO, be acquired and grow Fortune 500 revenues. I’ve built AI/ML working groups from 1 to 20 contributors, with a focus on ground truth: iterative release, measurable outcomes and end user feedback.

I founded an ML NLP startup in 2016, and I created the Pivotal Labs LLM research practice in 2019. I led the VMware AI/ML consulting practice. I currently shape strategy for the Tanzu AI platform as a service and lead an AI apps advisory practice for customers including Mastercard, Humana, Mercedes-Benz and Boeing. My advisory work is focused on product development fundamentals and safety, stability and community impact of AI applications; we are skeptical adopters.

Notable Outcomes

Grew total revenue for a 250-year-old bank by 8% with ML credit risk model.

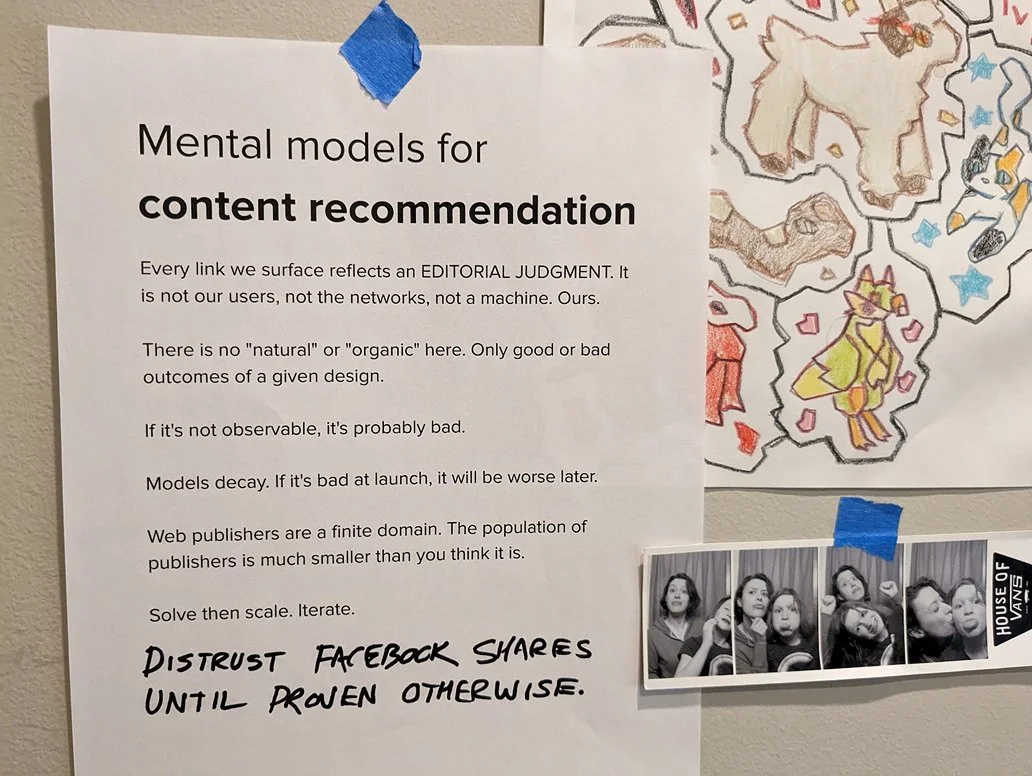

Grew social media newsfeed engagement by 15% via improved data cleaning.

Grew SAAS trial-to-sub conversion by 15% via data science + product partnership.

Partnership with Anthropic on Java SDK for AI agents using Model Context Protocol.

Boeing & Mercedes-Benz adopt Tanzu AI PaaS for AI engineering dev experience.

Shipped GenAI RAG-LLM chat prototype for nonprofit healthcare org in two weeks.

Led workshops at Mastercard on GenAI platforming in support of $100M platform sale.

Solo founder/dev of composable moderation service using NLP, shipped POC.

Publications

The New Stack: AI Agents: Why Workflows Are the LLM Use Case to Watch

The New Stack: The New Middleware: How to Be Productive With Agentic AI

VMware whitepaper: Data Science and the Balanced Team (editor)

VMware blog: It’s OK to ask why AI prototypes are not getting to production

VMware video: AI Hazards for Product Teams: Five Problems You’ll Have to Solve

Case study: Serving a ML credit risk model to point of sale in 300 branches

Role: Team leader

Nacional Monte de Piadad is a 249-year-old nonprofit lender. Using ML, NMP data scientists had discovered an optimal credit risk scoring model that worked on a spreadsheet, but needed to be built into cloud services using live data, hardened for production use with private transaction details. Validation of model performance required careful canary release and model eval.

I led an international, multilingual team through discovery, prototyping and deployment of the model via microservices, with integrations to data lakes and retail point of sale workstations.

Four months from kickoff, the new model was in with pilot customers, ramping to all 330 branch locations later that year.

Outcome: NMP is able to offer loans to previously denied clients without increasing defaults, improving credit access and growing total organization revenue by 8%.